- Have any questions?

- +91-9911721597

- support@dssoftweb.com

What| are| the| Different| Types| of| Financial| Ratios?

Introduction

Ratios always create a way of confusion, apprehension and nervousness. However, while these ratios could be tricky to reach , they provide you a transparent picture of the respective reports for enhancing the efficiency of your business.

One such crucial ratio is financial ratios that are created using numerical values extracted from financial statements through which business owners can gain meaningful information about their company. The numbers that provides a view of the financial position of the corporate include figures from record , earnings report , and income statement. These numbers are then wont to perform quantitative chemical analysis and assess a company’s liquidity, leverage, growth, margins, profitability, rates of return, valuation, and more.

5 ratios to consider to understand your company’s financial status

Financial ratios are categorised into 5 basic groups. Let’s have a glance at all of them and what they reveal!

Working capital ratio

For a corporation to assess its future, it's crucial that the business owner keeps an in depth eye on the capital . capital is nothing but a company’s ability to pay off its current liabilities with the assistance of its current assets. it's simply calculated by subtracting current assets from current liabilities. If the amount derived is positive, meaning that the company’s economic condition is stable, and it's safe for the investors to place in some money therein company.

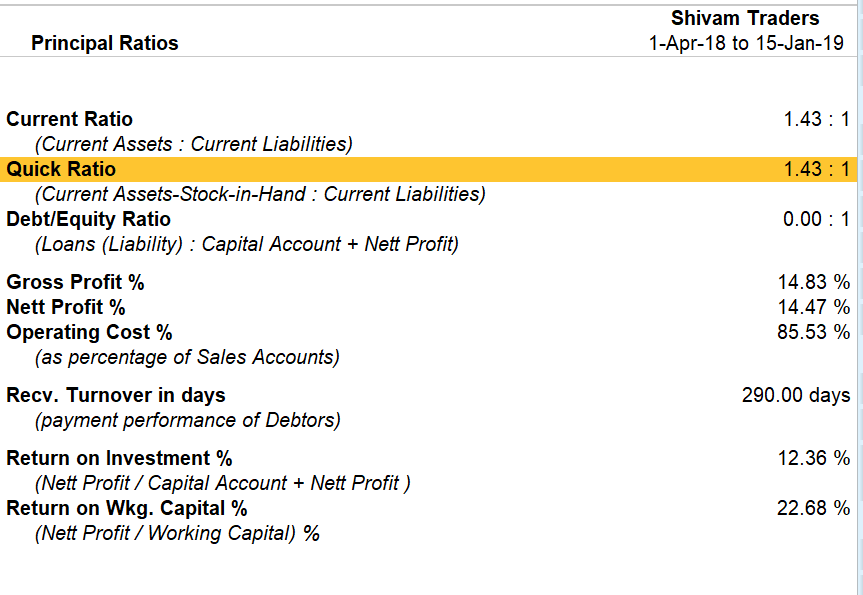

Another important aspect to assess the financial health of a corporation is to know its liquidity, and the way seamlessly can the corporate turn its assets into cash to pay off short term debts. The capital ratio is calculated by dividing current assets by current liabilities. to know this better, let’s say if a corporation has current assets of INR 4 crore, and current liabilities of INR 2 crore, which provides a 2:1 ratio, that’s pretty decent. However, if two similar companies each had 2:1 ratio, but one had additional cash among its current assets, that firm would be better ready to pay off its debts quicker than the opposite , because it features a higher liquidity ratio.

Quick ratio

This is also mentioned as appraisal ratio, during which the inventories are subtracted from current assets, before dividing it into liabilities. It basically helps you to assess the liquidity position and measure your company’s ability to satisfy its short-term obligations with its most quick assets . This ratio is taken into account to be a more conservative method than the present ratio, because it includes all current assets as coverage for current liabilities. For example: a corporation with a fast ratio of but 1 may unable to completely pay off its current liabilities during a short term. On the opposite hand, a corporation having a fast ratio above 1 can instantly get obviate its current liabilities. as an example , a fast ratio of 1.5 indicates that a corporation has INR 1.50 crores of quick assets available to hide each INR 1 of its current liabilities.

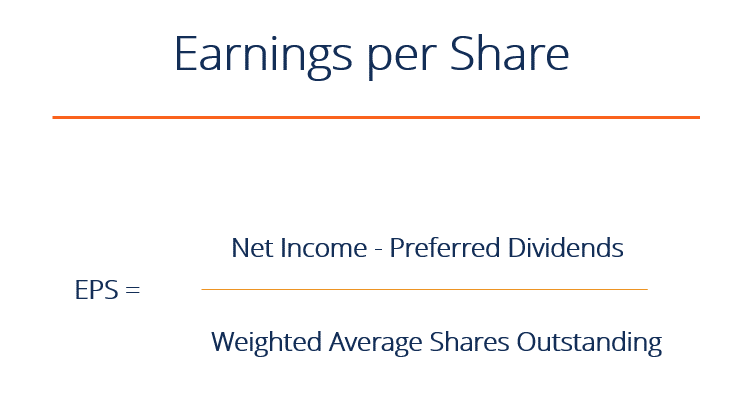

Earnings per Share (EPS)

Price-Earnings (P/E) Ratio

The price-to-earnings ratio aka P/E ratio helps in reflecting investors' assessments of those future earnings. It is basically the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS). It helps analysts determine the relative value of a company's shares in a simplified comparison.

A high P/E ratio could mean two things – either that a company's stock is over-valued, or that the investors are expecting high growth rates in the future. P/E ratio of a stock tells you very little about it, unless it’s compared to the company’s historical P/E or the competitor’s P/E from the same industry.

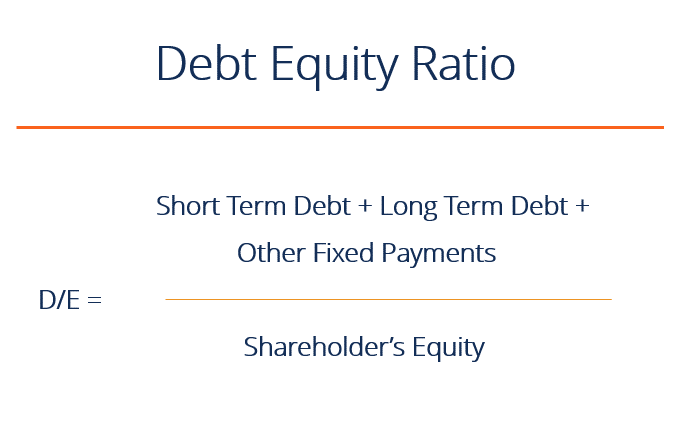

Debt-equity ratio

The debt-to-equity (D/E) is calculated by adding outstanding long and short-term debt and dividing it by the book value of shareholders' equity. When an investor approaches you to put money into your business, or buy stocks, you would obviously delve deeper into that investor’s credit worthiness. No sane business owner would want a prospective investor to be in huge debts, which would impact the overall financial stability of your business.

Higher leverage ratios tend to indicate a company or stock with higher risk to shareholders. However, the D/E ratio is difficult to compare across industry groups where ideal amounts of debt will differ.

How do financial ratios assess your business’ future?